》View SMM Cobalt and Lithium Product Prices, Data, and Market Analysis

》Subscribe to View Historical Spot Price Trends of SMM Cobalt and Lithium Products

I. Evolution of the Global Nickel Resource Structure: The Dominance of Laterite Nickel Ore Continues to Strengthen

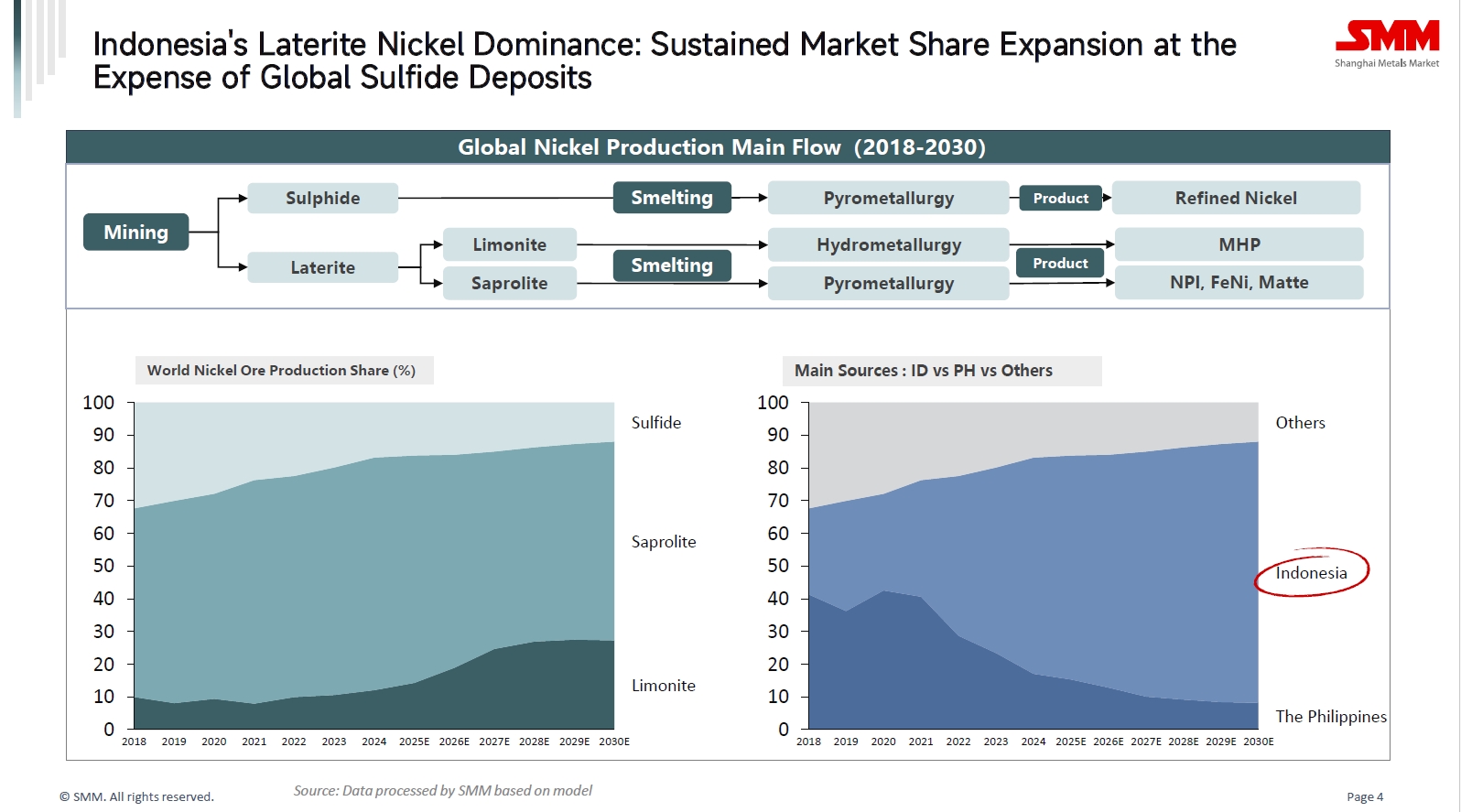

From 2018 to 2030 (projected), the structure of global nickel ore production is undergoing a fundamental transformation:

The share of nickel sulphide ore is expected to decline from 32% in 2018 to 12% in 2030, while the share of laterite nickel ore rises significantly from 68% to 88%, becoming the primary source of nickel ore. However, starting in 2023, competition among laterite nickel ores has gradually emerged. In 2023, pyrometallurgical ore accounted for 70%, while hydrometallurgical ore accounted for only 10%. By 2030, the share of pyrometallurgical ore is projected to decrease to 61%, while the share of hydrometallurgical ore increases to 27%.

The increase in the share of hydrometallurgy is primarily due to the gradual depletion of global high-grade nickel ore resources, making it an inevitable choice for the industry to develop the vast reserves of low-grade laterite nickel ore. At the same time, hydrometallurgical technology, with its comprehensive advantages in production costs, integrated recovery, and environmental friendliness, perfectly aligns with the industry's demand for low-cost, large-scale, and green nickel raw materials.

By country, Indonesia's share of nickel ore supply surged from approximately 26% in 2018 to nearly 80% in 2030, while the Philippines' share dropped from about 41% to around 8%, establishing Indonesia's absolute dominance in the global nickel resource supply chain.

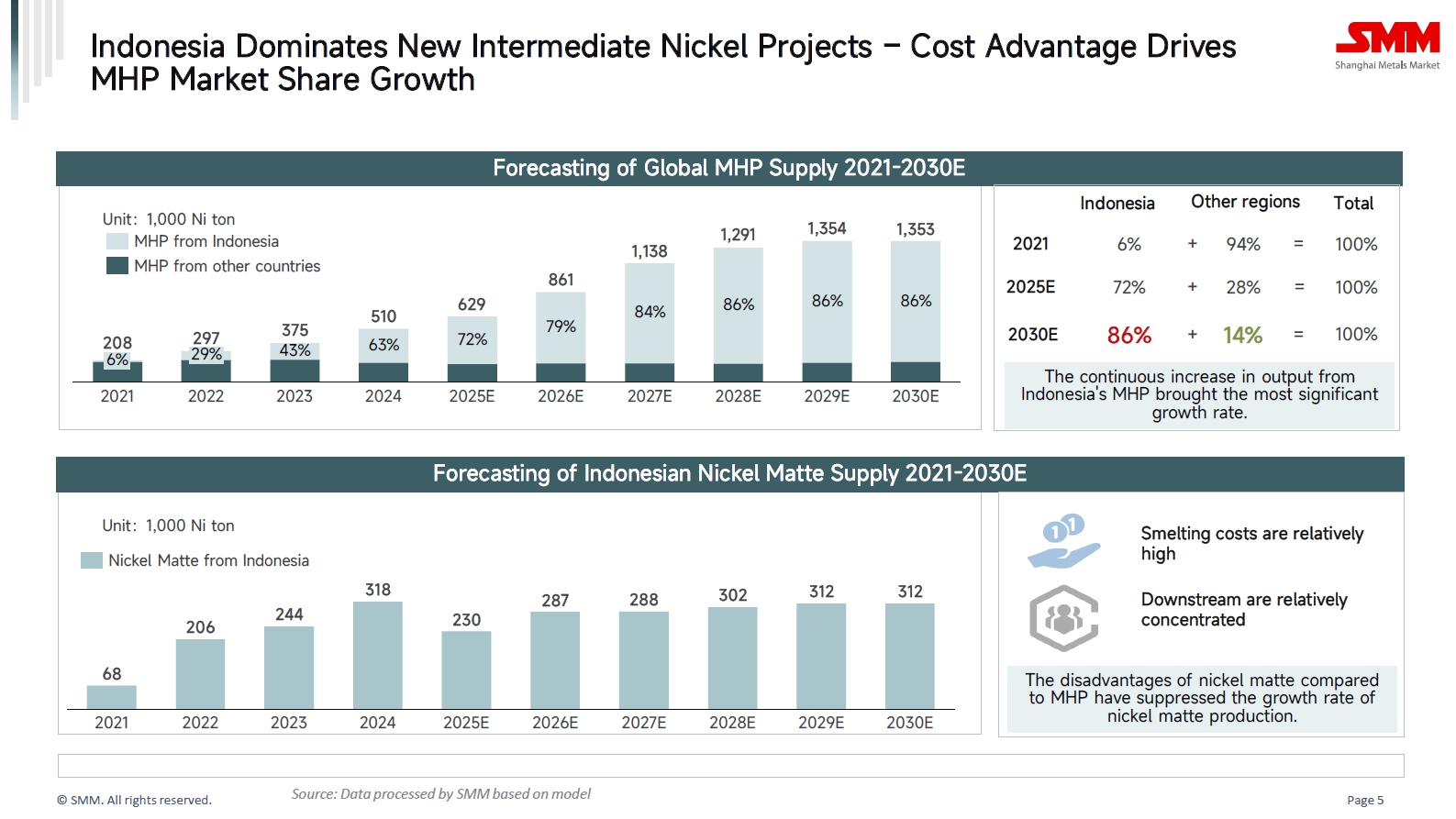

II. Indonesia Reshapes the Global Nickel Supply Chain Landscape with MHP

Indonesia has become the absolute growth driver for global nickel intermediates, particularly Mixed Hydroxide Precipitate (MHP). Its cost advantages are squeezing the survival space for intermediates from other regions and high-cost processes like high-grade nickel matte. Global MHP supply skyrocketed from only 208,000 mt Ni in 2021 to a projected 1.353 million mt Ni in 2030, with Indonesia's global share soaring from 6% in 2021 to a projected 86% in 2030.

In contrast to the surge in MHP, the growth of nickel matte supply in Indonesia appears particularly moderate. From 2021 to 2030, nickel matte supply is projected to increase only from approximately 68,000 mt Ni to 312,000 mt Ni, with a growth rate far lower than that of MHP. This is mainly due to its relatively higher smelting costs, a more concentrated downstream market, and limited application fields.

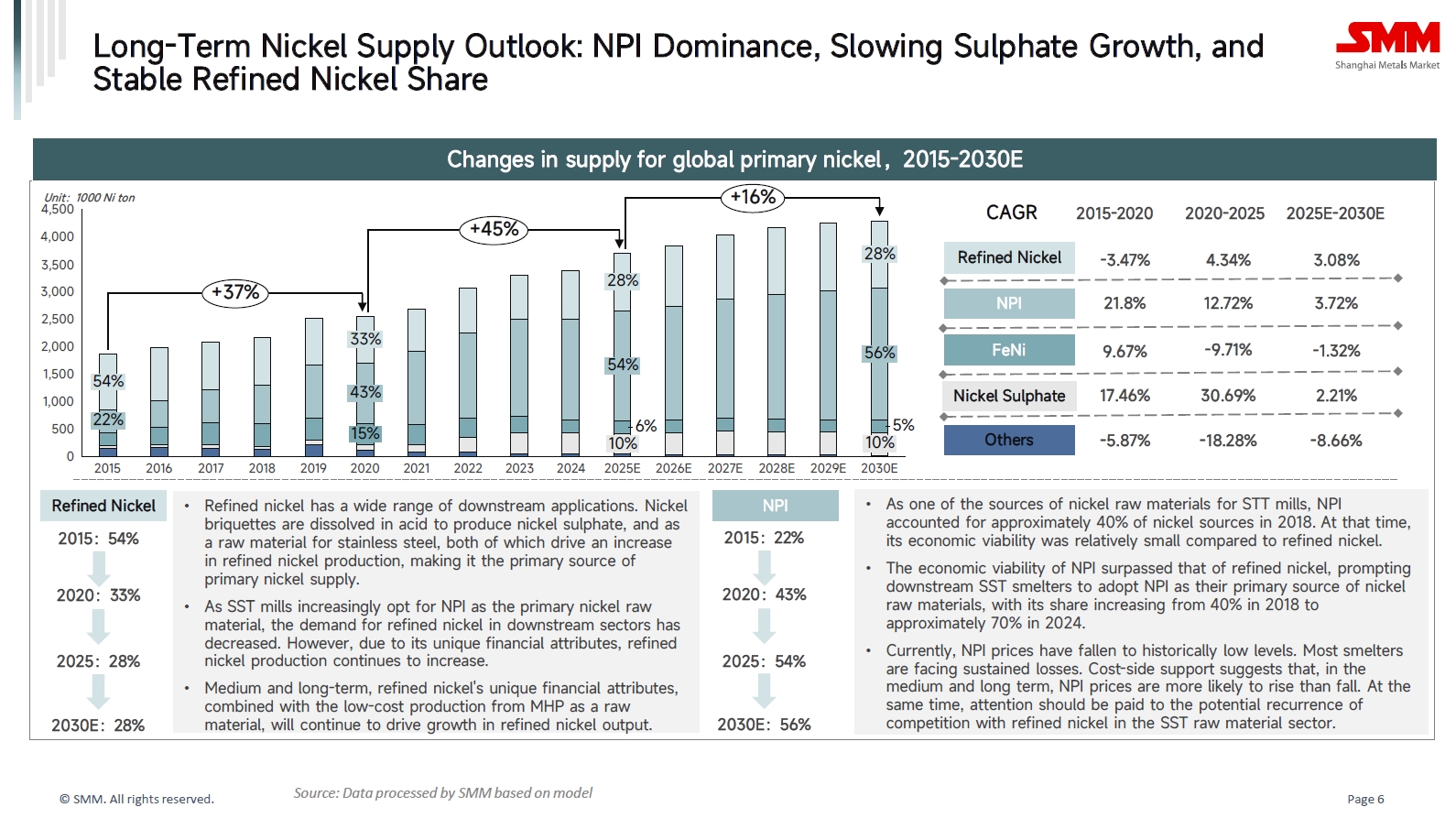

III. Supply Side: The Dominant Position of NPI Continues to Strengthen, Nickel Sulphate Growth Slows Down, and Refined Nickel Remains Stable

(1) NPI: An Industry Revolution Driven by Cost Advantages

As one of the nickel raw material sources for stainless steel mills, Nickel Pig Iron (NPI) accounted for about 40% of nickel raw materials in 2018, when its economic viability was relatively small compared to refined nickel. As NPI's economic viability surpassed that of refined nickel, downstream stainless steel smelters gradually adopted NPI as the primary nickel raw material source, increasing its share to 70% by 2024. Currently, NPI prices have fallen to historical lows, with most smelters facing sustained losses. Supported by costs, NPI prices are more likely to rise than fall.

(2) Refined Nickel: Unique "Financial Attributes" Build a Moat

As a "standardized product," refined nickel has a wide range of downstream applications. It serves as one of the raw materials for producing nickel sulphate and is also used in high-end stainless steel, special alloys, and electroplating. Additionally, refined nickel can be delivered on the LME and SHFE, and this financial attribute supports the rigidity of its production and demand, freeing it from the volatility associated with being solely an industrial metal. In the medium and long term, the use of low-cost MHP as a raw material to produce refined nickel will further enhance its economic viability and drive production growth.

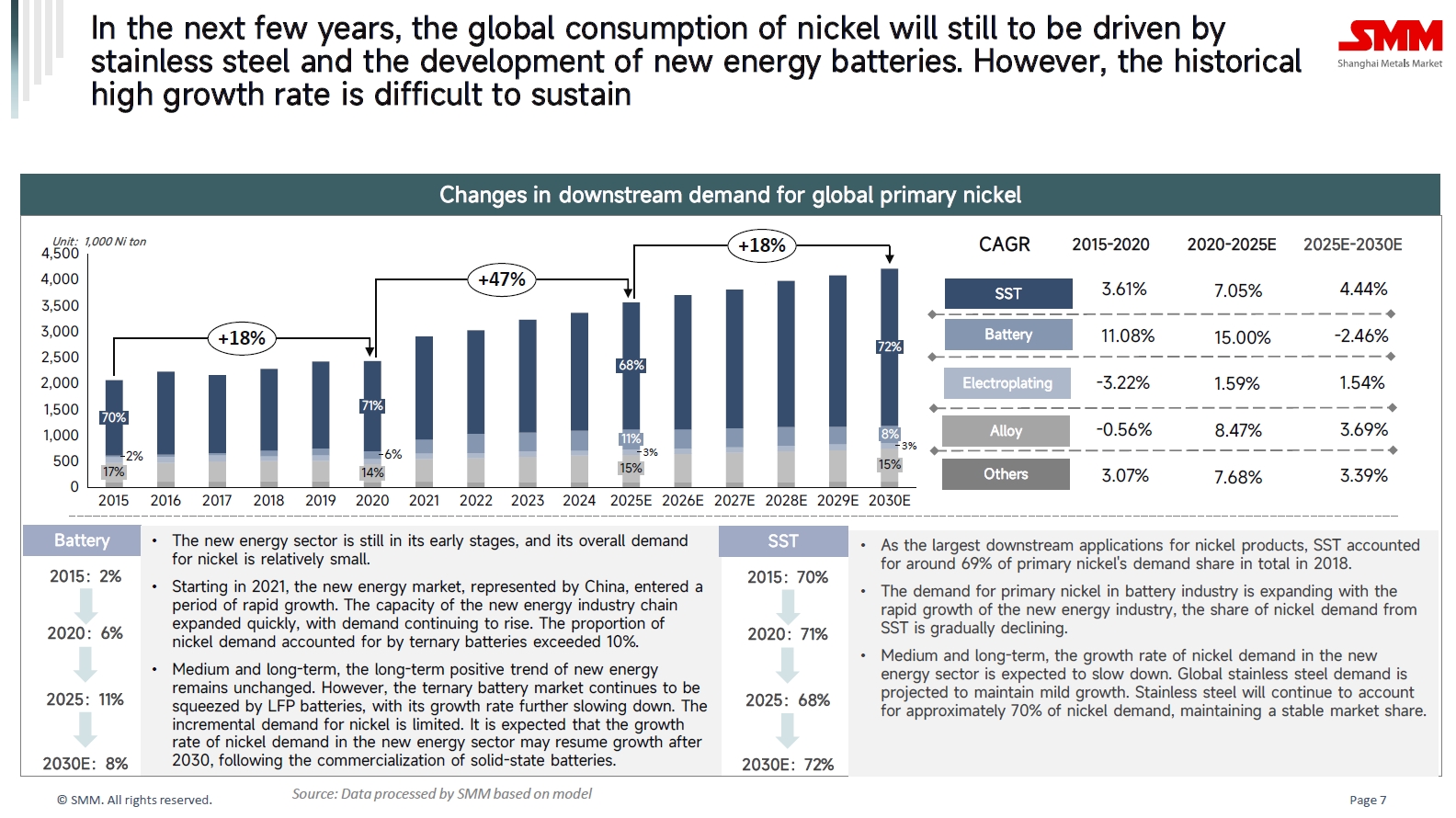

IV. Demand Side: Stainless Steel Demand Remains Stable, Battery Growth Enters a Plateau

2015-2020: Stainless Steel as the Absolute Dominant Sector

In 2015, stainless steel accounted for nearly 70% of primary nickel consumption, while batteries accounted for only 2%. At that time, the new energy market was still in its infancy, and the overall demand for nickel was relatively small.

2020-2025E: Explosive Growth in Battery Demand

The new energy market, represented by China, entered a phase of rapid growth, with the demand share of ternary batteries exceeding 10%. During this period, batteries were the main contributor to demand growth, but stainless steel still maintained a high share of 68%.

2025E-2030E: Slower Growth in Batteries, Stable Demand for Stainless Steel

In the power battery sector, the ternary battery market continues to face pressure from LFP batteries, leading to a decline in its own growth rate. Until the large-scale commercialization of next-generation solid-state battery technology, the potential for nickel demand growth in batteries remains limited.

Meanwhile, global stainless steel demand is expected to maintain mild growth. Due to its large volume, it will continue to account for approximately 70% of primary nickel demand.

V. Short-Term Nickel Price Dynamics: A Complex Game of Coexisting Surplus and Support

(1)Solid Cost Support: Since the end of 2024, high-grade nickel matte produced from NPI has been continuously losing market share to MHP, but no new MHP projects are expected to come online in the short term. Policies in the DRC have tightened cobalt supply, increasing the value of cobalt in MHP and triggering speculative stockpiling, further exacerbating the tightness in MHP supply. The rapid rise in MHP prices has driven up production costs for refined nickel using MHP as a raw material, limiting the downside room for nickel prices.

(2) Financial Attributes Provide a Buffer: Refined nickel is traded on the LME and possesses strong financial characteristics. Against the backdrop of interest rate cuts by the US Fed and global monetary easing, ample liquidity provides macroeconomic support for non-ferrous metal prices, including nickel.

(3) Policy Disruptions in Indonesia: Indonesia's nickel ore policies remain tight. On October 3, 2025, the Ministry of Energy and Mineral Resources of Indonesia officially issued Ministerial Regulation No. 17 of 2025, reverting the RKAB approval system from a three-year term back to an annual system, to be reinstated starting in 2026. Smelters, concerned about future ore supply deficits, are engaging in advance raw material stockpiling, which is boosting market sentiment and demand in the short term.